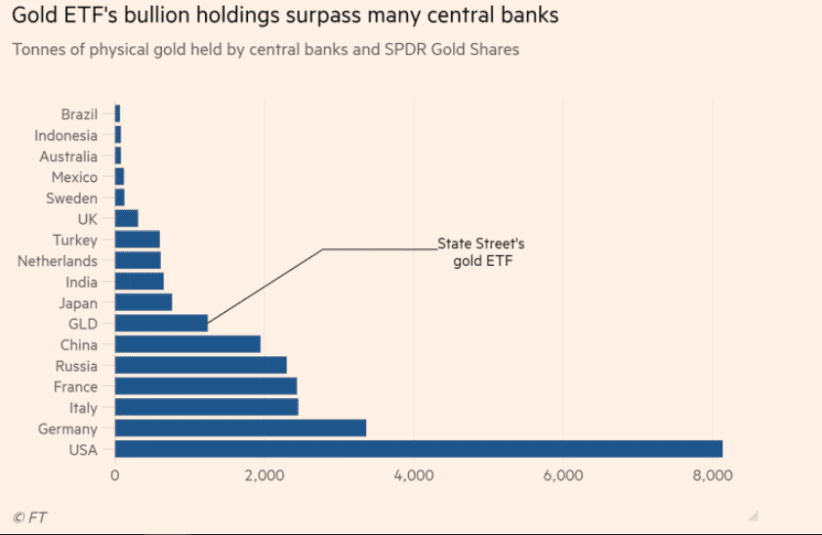

A publicly traded fund became one of the world’s largest owners of the precious metal, surpassing even the central banks of Japan and India.

A publicly traded fund became one of the world’s largest gold owners, outperforming even the central banks of Japan and India as investors rushed to buy the precious metal and pushed its price to record levels amid a global search for refuge from the crisis unleashed by the coronavirus.

It is SPDR Gold Shares an ETF – an investment fund whose main characteristic is that it is traded in secondary securities markets – that owns physical bullion instead of only financial derivatives. The firm accumulated gold this year as investors seeking price gains or a safe haven asset funnel more money into the fund.

The size of the fund’s holdings, held in HSBC’s London vaults, increased to 1,258 tonnes. On Monday and Tuesday alone he added another 15 tons, about five times more than Michael Caine’s bank robbers in The Italian Job, based on the $ 4 million worth of gold taken in the 1969 film.

The ETF is a partnership between State Street, a large Boston bank, and the World Gold Council, a trade body for the industry. It marked a 33% return this year that helped lift its value to more than $ 80 million.

Gold’s rally continued Tuesday evening as the metal’s price topped $ 2,000 per troy ounce for the first time. The size of the fund, known by its GLD ticker, places it among the ranks of the major central banks. Its holdings are equal to a quarter of all the gold at Fort Knox in the U.S. More than the gold reserves of the Bank of Japan, the Bank of England or the Reserve Bank of India, and not far from the 1,948 tons of China. precious metals, according to WGC data.

The enthusiasm for the metal was fueled by some investors who worry that extraordinary moves by central banks to cushion the economic impact of the coronavirus could ultimately ignite latent inflationary pressures. Gold is widely viewed as insurance against accelerating price increases. Wells Fargo analysts called the precious metal a “chameleon” as the causes of its recovery evolved.

“From 2016 to 2019, gold closely followed the decline in global long-term interest rates. Then, in early 2020, the recovery in gold added to fears of the coronavirus and excessive global money printing, ”they noted in a note on Monday.

“More recently, gold jumped on the train in US dollars; climbing above $ 1,900 as the US dollar became one of the weakest currencies on the planet. “GLD was one of the first commodity-based ETFs when it launched in 2004. Its ownership of stored physical gold bullion Somewhere in London it sets it apart from many of its newer peers, who mostly use commodity futures, its shares are priced at about one-tenth the cost of an ounce of gold.

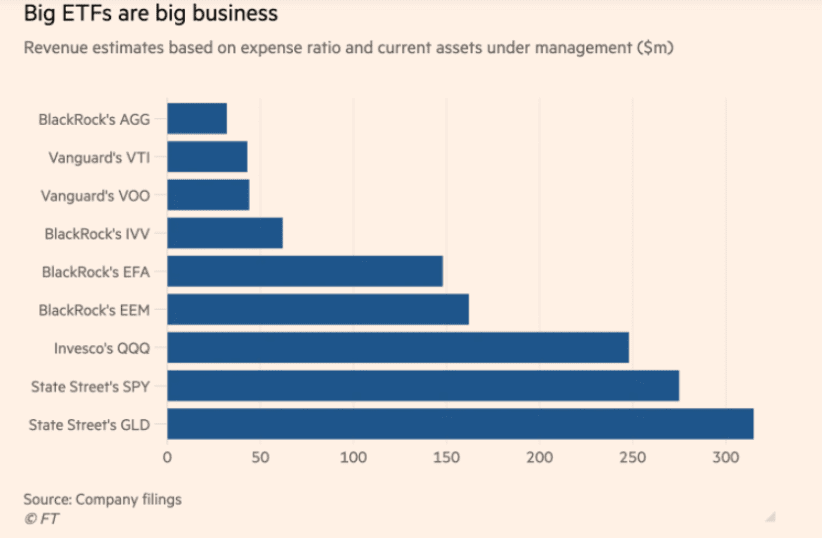

GLD’s growing popularity also made it the ETF industry’s biggest money maker, surpassing even the revenue generated by State Street pioneer SPDR, also known as “Spider,” which tracks the US stock market.

The stock market ETF, which is comfortably the largest in the world with $ 289 billion of assets, charges end investors a fee of just 0.095% a year, which means its gross income to State Street is currently at approximately $ 275 million annually.

GLD, on the other hand, costs investors 0.40% annually, which means that it is currently generating about $ 320 million of revenue a year. ETFs were first invented in the early 1990s as a way for investors to trade index funds around the clock, but in subsequent years Wall Street put a wide range of assets into the structure, from stocks and shares. bonds to more complex securities, such as risky loans and derivatives linked to volatility.

Source: https://www.cronista.com/finanzasmercados/Quienes-son-los-mayores-dueno-del-oro-en-el-mundo-20200806-0007.html